Changes to 1099 filing process for non-employee compensations

The Department of Treasury has changed the 1099 filing process for non-employee compensations.

For 2020 there is a change to the 1099 reporting requirements. All payments previously required to be reported in BOX 7 of Form 1099-MISC are now required to be reported on an entirely new FORM 1099-NEC (Non-Employee Compensation).

Required Updates

If you are currently using versions PU9, V11, or V12 please contact RKL so the Sage X3 1099 update patch can be installed on your system. This update will add the NEC boxes and new 1099 changes to X3.

For versions prior to PU9 please contact RKL for assistance.

1099 Box

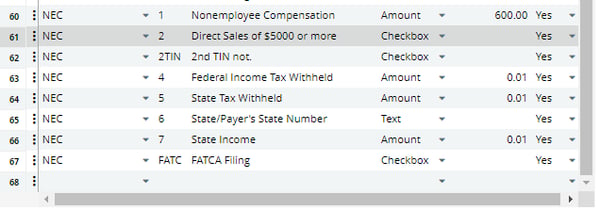

Once the 1099 updates are installed the new NEC Boxes will be available.

Go to Declarations > Fee Declaration > United States > Setup > 1099 Box to view the new Boxes

Updating Vendors to use Form 1099-NEC

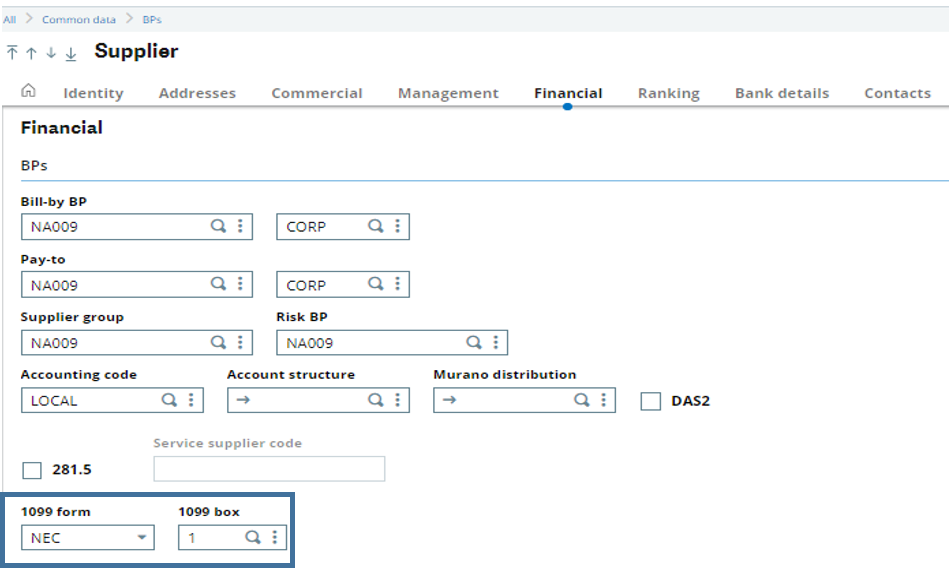

Once the update is installed the supplier records will need to be updated with the new NEC Form and 1099 Box. These changes will be used on all future invoices for the supplier. Previous invoices will need to be updated.

- Go to Common Data > BPs > Supplier

- The 1099 form and 1099 box can be updated on the Financial tab

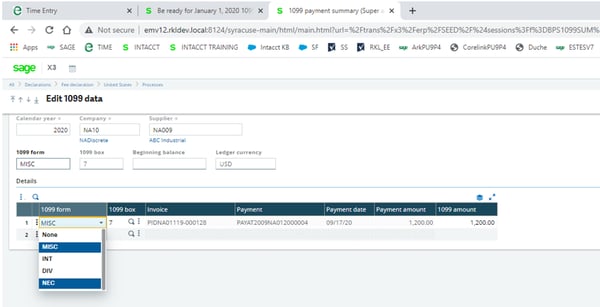

Updating the 1099 Transactions to NEC

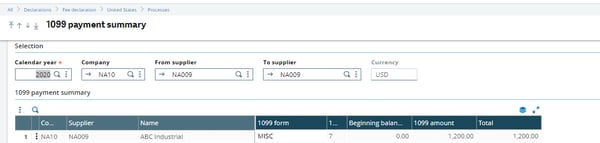

After calculating the 1099 payments any existing transactions can be updated to move amounts from 1099-MISC Box 7 to Form 1099-NEC Box 1.

- Go to Declarations > Fee declaration > United States > Processes > 1099 Payment Summary

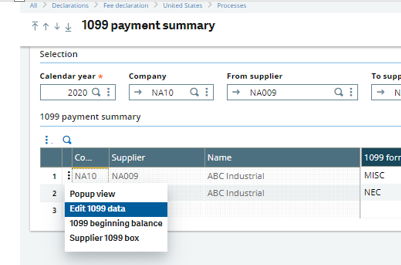

- Click the Action button for the MISC line in the grid and select Edit 1099 Data.

Printing 1099-NEC Forms

Question - Will I be able to print the new 1099-NEC forms form Sage X3 for 2020 filings?

If you require additional assistance with updating your 1099 Suppliers and/or transactions please reach out to RKL for assistance.