There's a new form for tax year 2020 filing

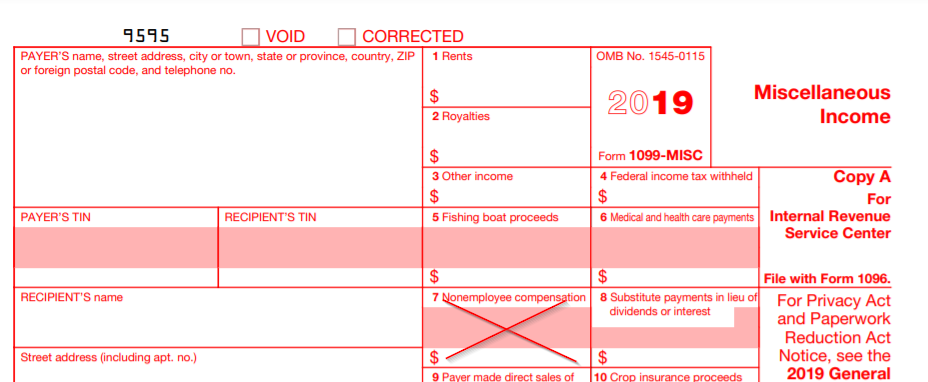

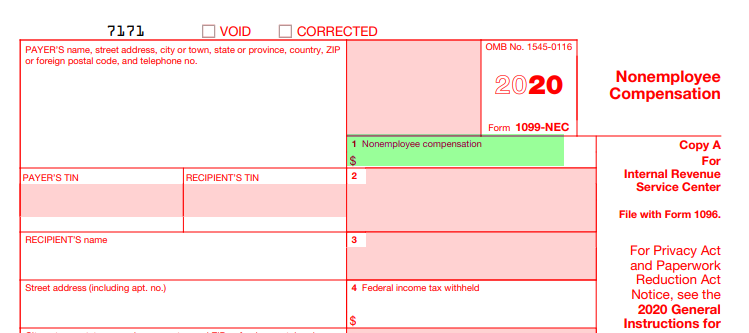

As of this year, the 1099-MISC Box 7 Nonemployee compensation has been moved to the new 1099-NEC Box 1.

With recent changes, the IRS required that these amounts be filed with the IRS by January 31st, causing confusion as other amounts on the 1099-MISC form didn’t have to be filed until the end of February.

The IRS’s answer this year was to move them to a separate form.

For an in depth discussion of the change, please go to the RKL, LLC blog on the subject.

Form 1099 Changes for Tax Year 2020: Is Your Business Prepared?

What does that mean for reporting from Sage 500?

To use the full processing power of Aatrix on-line services and Sage 500 to produce your 1099’s you will need to upgrade your installation with the Sage product update which will be available mid to late December 2020. Sage is working diligently to get this out to the user base, but final testing can’t be completed until the Aatrix services side is ready for testing.

To install a Sage update, you will need to be on a currently supported version of Sage (v2017 or later). RKL Support can assist with this if desired. RKL is finishing comparable updates for prior versions. Due to the number of updates we are expecting to assist with this year, we are keeping a central list that you can access on line: Request For 1099 Assistance

In short, what these updates are expected to do:

Add the new form and box to the system, and the ability to process it in all areas in accounts payable and purchase orders that refer to the 1099 form and box.

Update existing defaults and activity for 2020 from 1099-MISC Box 7 to 1099-NEC Box 1.

Unsupported versions with or without RKL updates

If you are not on a version supported by Sage, you can still process 1099s, but you will not be able to print these forms locally from Sage 500 as in prior years. Your Sage system also does not support creating the standard e-file format with the new information.

With the updates installed, you can download the 1099 information (form, box, payment amount, vendor address) into an Excel file from Explorers or reports.

Then you can use a number of available on line services where you can upload the data and, for a fee, either have the option to locally print out 1099s, or purchase full services that will print and mail 1099’s and e-file with the IRS. (Just do a search for “1099 online filing services”.)

Note: if you are on a version Sage 500 ERP with Aatrix but not supported by Sage (v2014 with the January 2016 or later update, or v2016) and apply the RKL update, you will be able to download a file, but RKL can’t test or confirm whether directly links to Aatrix will work at this point.

Last, if you don’t care to upgrade your Sage 500 system at this point, you can still process 1099s. When you extract the information in Excel for upload to a service, you would need to manually change all “1099-MISC Box 7” lines to “1099-NEC Box 1” before uploading it. (Contact RKL support if you don’t yet have but would like a 1099 Explorer to review and pull vendor payments with 1099 history).

You can click on this link to see details of the Sage 500 ERP / Aatrix Integration. (Prices subject to updates): https://partner.aatrix.com/sage500

If you require additional assistance with updating your 1099 Suppliers and/or transactions please reach out to RKL for assistance.