Getting ready to process your quarter-end payroll?

Sage has changed the way it retains payroll history so that you don't have to reconcile and finish the prior quarter or create a back company to run quarter-end processing. Below outlines the changes that were made and RKL eSolutions recommendations for processing quarter-end and year-end payroll in Sage 100 Payroll.

Payroll History (and Table) Changes

According to Sage, history is retained in the PR_40 table as of Sage 100 v2013. This same table exists in the new Payroll module, and enables Aatrix reporting to access prior year history per the constraints in Payroll Setup Options.

This change in how Sage retains payroll history enables us to close the quarter and process payroll in the new quarter without the stress of reconciling and finishing the prior quarter first, or creating a backup company in Sage before running quarter-end processing in the live company. The earlier requirement to create backup companies for each payroll quarter-end before running quarter-end processing in the live company is no longer a “requirement”.

Continue to create backup payroll companies

RKL eSolutions strongly recommends that you continue to create backup payroll companies before processing quarter-end in the live company. This should be done until you are comfortable that any historical reporting requirements you may have, are properly handled in the live company.

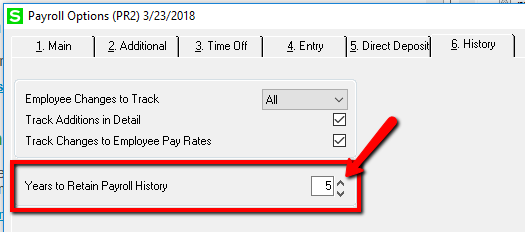

Review Payroll Options

Please be sure to review your Payroll Options (in Setup) settings for history retention. Increasing the number of retention years impacts processing going forward; it does not resurrect data that has already been purged. Do not remove any historical payroll companies going back further than your current setting unless you are certain you no longer need access to the data.

Important Notes Regarding Aatrix

Aatrix history is written to a file retained on the local workstation where the reporting was done. The results is, to access payroll history processing via Aatrix, you must use the workstation where Aartix was run to process the quarter-end and year-end filing.

A better alternative: according to Aatrix’ support team, you can save reports to an IP address on the server so multiple users can access the information on any given workstation where Sage and eFiling are installed. For details, please reach out directly to Aatrix Support and provide them your account Aatrix information, or contact your RKL representative if you would like our assistance.

Per Aatrix:

- History files give you access to prior reports that have been eFiled, printed for mailing, or saved. History may be accessed different ways depending on the accounting software but will always be accessed from the form selection window. Some examples of what the option to choose may be: "Saved Report", "Form Type: History", "Existing Reports".

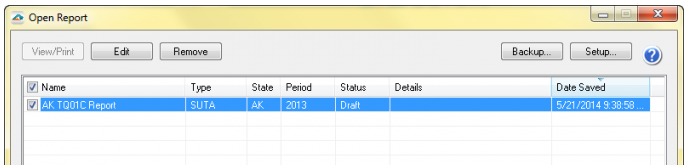

- When History is generated a list of previously saved reports will appear in an "Open Report"

- Unfinished eFile or Print and Mail reports will appear as a "Draft" under the Status column.

- Finished eFile or Print and Mail reports will appear as "Record" under the Status column.

- History files are saved on the client side, not the server side. If you do not see the particular report in the "Open Report" list, it may be saved in a different location "database" within the accounting software, likely in the database that the report was filed from, or possibly on the machine the report was processed on. History files may also be set to store in a network location.

Quarter End Processing Impact

Just to have the information at your fingertips, below is a list of tasks Sage Payroll Quarter-End processing executes:

- Clears quarter-to-date fields in the Employee Master file

- Clears the Check History file if 'Retain Year to Date Check History' check box in Payroll Options is not selected

- Purges the Quarterly Tax Recap file

- Purges the Workers' Compensation file for the workers' compensation code if 'Quarterly' or 'Monthly' was selected in the 'Type of Limit' field in 'Workers' Compensation Maintenance'.

- Increments the current quarter in Payroll, Setup, Payroll Options. Note: NEVER manually change the quarter or year in Payroll Options.

Reminder – Quarter-End and Year-End processing in Payroll cannot be undone once executed.

Payroll Quarter End Checklists

There are standard checklists available in Sage’s Knowledgebase, maintained by Sage if/when any changes to Payroll Quarter/Year-end processing impact the task list. You may also have a checklist built with/for you by the RKL eSolutions team. Please do not hesitate to reach out to your RKL representative or the RKL Support team at support@rklesolutions.com if you would like our assistance.

There are standard checklists available in Sage’s Knowledgebase, maintained by Sage if/when any changes to Payroll Quarter/Year-end processing impact the task list. You may also have a checklist built with/for you by the RKL eSolutions team. Please do not hesitate to reach out to your RKL representative or the RKL Support team at support@rklesolutions.com if you would like our assistance.

Ask a Question