To help you get a jump start on closing the year out smoothly, here are some of the most Frequently Asked Questions and answers related to the General Ledger in Sage 100.

General Ledger and Reporting

Can I print financial statements for the next fiscal year PRIOR to performing year-end processing?

YES. In the Fiscal Year field within the applicable report window, simply select the fiscal year to print. Do NOT manually change the fiscal year in General Ledger Options in order to print financial statements for the next fiscal year.

After year-end processing, can I delete accounts that will no longer be used in the new fiscal year and still run comparison statements?

Information about prior fiscal years is stored by account number. These account numbers must be retained for as long as you require comparisons. Instead, you can set the status of an account to Inactive to prevent future postings but still retain the account number for comparisons. On the Main Tab in Account Maintenance, select Inactive in the Status field and click Accept.

Can I open a closed fiscal year to make General Ledger postings/adjustments?

YES. If you retained detail history for a prior fiscal year by entering the 'Years to Retain General Ledger History' field in GL Options, you can reopen the closed fiscal year and post to it.

To Post to a Closed Fiscal Year:

- Select General Ledger Setup menu > GL Options

- On the Main tab, in the Current Fiscal Year field, select the past fiscal year to reopen

- In the Current Period field, select the accounting period to post to and click Accept

- In General Journal Entry or Transaction Journal Entry, enter the transaction to the reopened fiscal year and period and update the journal entry.

- Reprint year-end reports when you’re finished

- Go back to General Ledger Options Main tab and select the current year in the Current Fiscal Year field, and the current period in the Current Period field. Click Accept.

You've just re-opened the closed fiscal year, posted a journal entry, and reverted back (in step 6) to the current fiscal period and year. Note: Closed fiscal years can only be reopened in the General Ledger module.

Electronic Reporting Module Retired

As a reminder, the Electronic Reporting module was retired as of this year. Even though Sage will no longer be updating the standard pre-printed payroll and accounts payable tax forms (W-2, 941, and 1099) and the Electronic Reporting module for all versions as of tax filing year 2017, you can still print all of these forms using the Federal or State eFiling menu tasks.

You will be able to print and/or electronically file W-2, 941, 1099, plus 330+ signature-ready federal and state tax forms to plain paper. There is no cost for printing to plain paper. Fees only apply for forms and/or reports that are actually electronically filed by Aatrix.

Payroll Customers Read the Sage 100 Payroll Period End Processing Procedures and/or Watch the Webinar Replay

Supported Versions Reminder

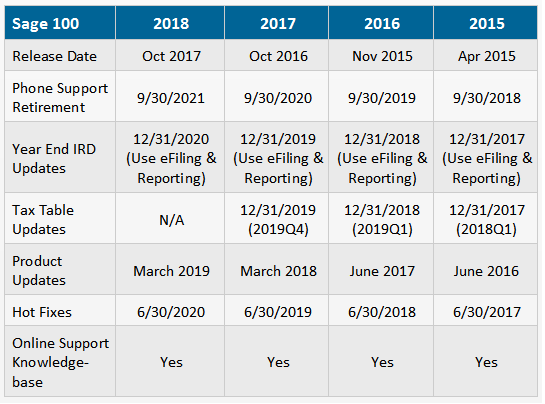

Sage officially supports the current plus 3 prior versions of Sage 100. Here’s a glance at the current versions and support retirement dates: We are Here to Help

We are Here to Help

As you begin year-end closing in Sage 100 and prepare to start fresh in 2015, be sure to contact us if you need assistance during this important time of year. As your software and technology partner, we’re always here to help!

Related Articles

Sage 100 Road Ahead

Sage 100 ERP Module Closing – Keeping Things in Order

How to Create a Backup Company