The deadline for implementing the ASC 606 guidelines may have come and gone—at least for public companies—but the burden of compliance remains. As an article in the Wall Street Journal points out, the new revenue recognition criteria replaces the old revenue guidance, enhances the related disclosure requirements, and requires your organization to use “significant judgment” when applying the rules. All this means you have to rethink your contracts and commercial processes.

“Some of the operational aspects of the new revenue standard seem to present the greatest challenge,” observed Eric Knachel, senior consultation partner, National Office, Deloitte & Touche LLP, at a Compliance Week conference. “There is a significant amount of judgment around applying the new standard, and while similar facts should be followed by similar judgments; in practice, organizations may bump up against the notion that facts can be interpreted differently.”

Revenue Recognition Criteria: The perils and pitfalls of ASC 606 compliance

If you’re not already, you’ll soon become familiar with the operational challenges of implementing one of the most sweeping accounting changes in a decade. Fortunately, you don’t have to go it alone. With best-in-class cloud financial management software like Sage Intacct to automate and simplify core processes, compliance can be virtually pain-free.

Consider these challenges:

1. Being consistent

“Many organizations may find that creating a framework to apply judgment consistently to customer contracts may be one of the more challenging implementation tasks related to the revenue standard,” said Christian Chiriatti, managing director, National Office, Deloitte & Touche LLP.

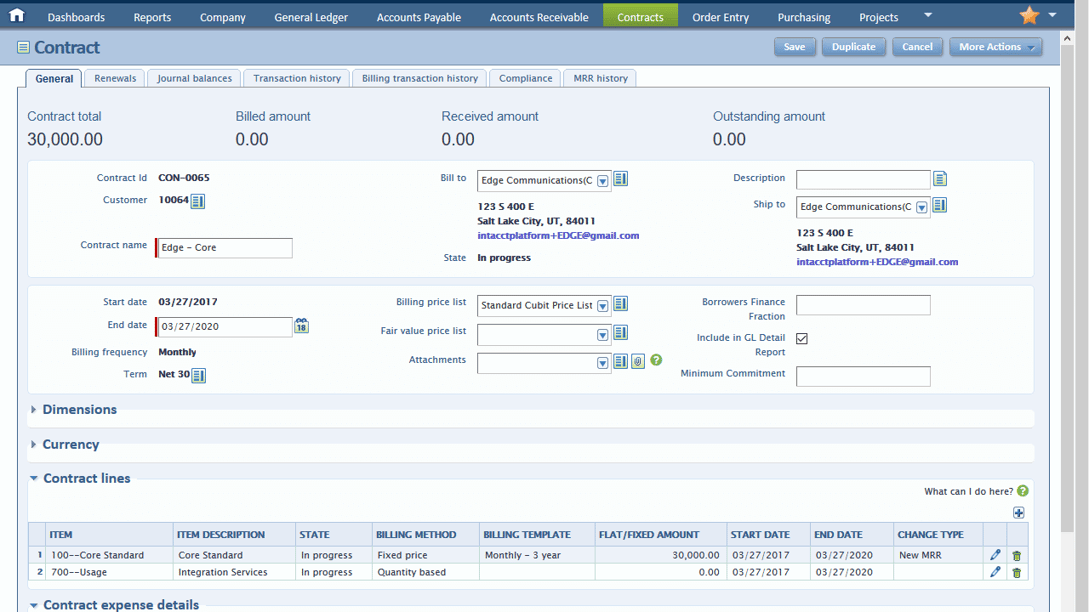

For example, when a contract changes because of add-ons, discounts, or upgrades, you have to reallocate revenue and expenses across the contract. What’s more, ASC 606 also applies to accounting periods that are already closed. Sage Intacct offers a Contract Revenue Management module that lets you recognize revenue and amortizes expenses, even as subscriptions and contracts change. You can add updates to a contract and let the system handle reallocation of revenue automatically—even into closed periods.

2. Dual reporting

Already may have become a way of life as you transition to the new guidelines, which means having two sets of financial books—recording revenue and expense under both the old and new sets of rules. Sage Intacct eases your workload by automatically applying both sets of criteria to each transaction. In addition, dual reporting functionality helps you transition to the new reporting rules when contracts span the cutover period.

3. Having the right technology in place

To comply with the standard’s new accounting and disclosure requirements, “organizations may have to document new or different judgments and gather and track information they may not have previously monitored,” Knachel said. Systems and processes associated with such information may need to be updated so finance can gather the additional data elements that may not currently be supported by legacy systems.

Designed specifically for the cloud, Sage Intacct helps you to run your business more smoothly and gain visibility into its financial and operational performance far better than you can with legacy, on-premises systems. And you can add an unlimited amount of data dimensions—such as department, building, division, job, or project—to the line level in any transaction and combine them however you want to get detailed reporting and analysis. Getting the data you need to comply with the new revenue recognition criteria has never been easier.

Pains of ASC 606 Compliance Getting you Down, Turn to Sage Intacct!

It’s easy to use and automates complex processes so you can worry less about compliance and more about adding value to your business. Ready to get started? Contact RKL eSolutions today!