Account groups organize GL accounts and categories into reusable structures that can be inserted into financial reports or nested together to make complex computations. Users can create as many account groups as needed and use them as building blocks for financial reports and dashboards.

Creating Account Groups

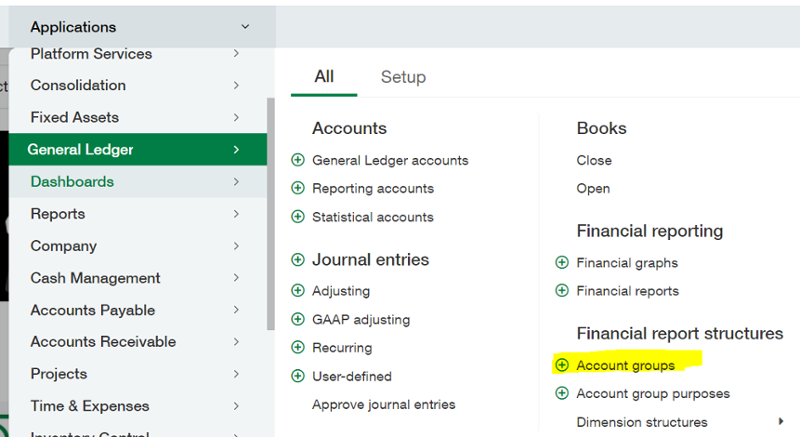

In order to create your account groups, navigate to Applications > General Ledger > Financial report structures > Account groups.

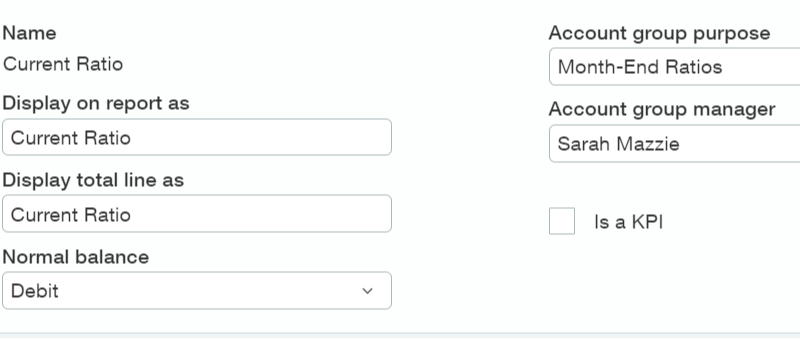

The header area for creating a new account group gives us many customization options. For example, the name and display name for account groups can differ. You can also update the normal balance (debit or credit) depending on your needs.

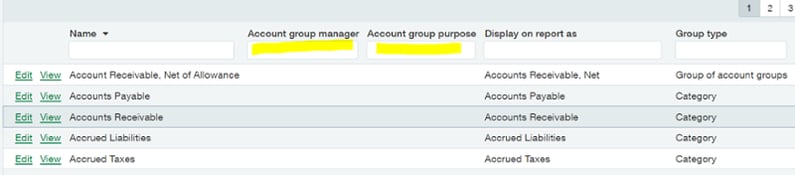

Using the account group purpose and manager fields is a great way to keep your account groups organized. These fields become searchable in the account group table.

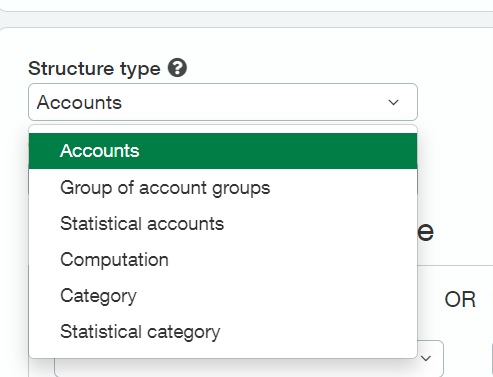

The structure type section of the account group gives us several options. You can choose from a group of account groups, statistical accounts, computation, category, and statistical category.

Group of Account Groups

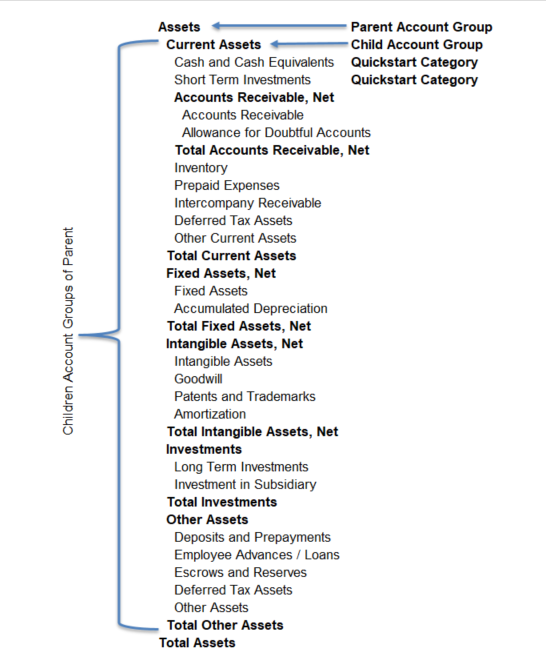

A group of account groups allows you to create several account groups and nest them together. For example, the “Asset” group allows you to group several account groups together, including current assets, fixed assets, inventory, etc. Create a new account group for nested account groups anywhere you would like a subtotal area to be. In the example below, you can see the nesting of categories and account groups, creating subtotals where needed.

3 Types of Account Groups

Accounts and Statistical Accounts

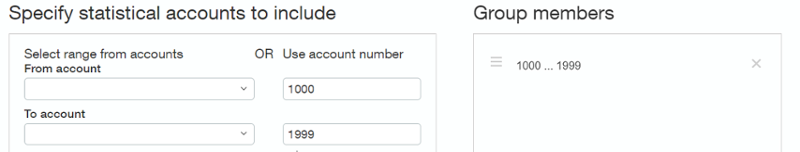

This structure type allows users to pick certain accounts or a range of accounts. When setting up your GL account numbering, it’s helpful to consider this. When you set up a range of numbers in an account group, any new GL accounts within that range will automatically be added to the account group. This cuts down on the maintenance of the account groups and financial statements.

*Pro Tip: Your company may benefit from setting up a smart event to email the person managing custom account groups. This allows you to be notified of new GL accounts, and the account group manager can review which account groups this new GL account should be added to.

Example of Using a Range of Accounts

In the example below, I have the following fields entered under "OR Use account number":

- From account - 1000

- To account - 1999

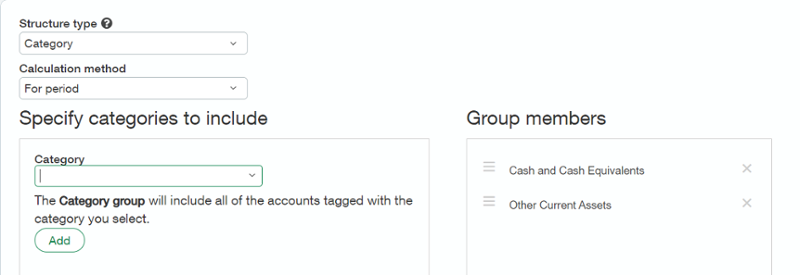

Category & Statistical Category

When you set up your GL accounts, there is a field named “Quickstart Category” that allows users to choose where this GL account will fall on your financial statements. This is because the financial statements are built with account groups, and many of them pull financial data from account groups that use these categories.

With account groups, you can choose your own categories. This allows you to fully customize a financial report for your needs. Creating these custom account groups won’t interfere with any of your existing financial statements. You can create as many as needed; they will all work independently of each other. You can also use existing ones as a foundation to build your own or nest them together.

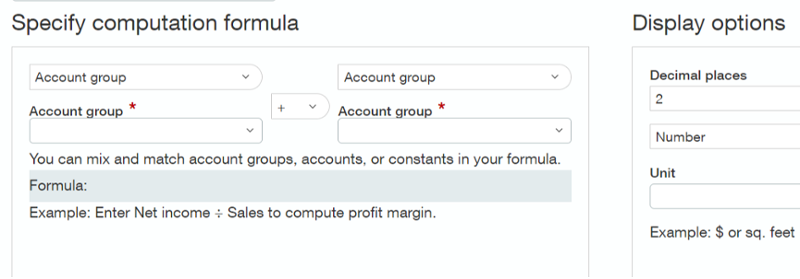

Computations

Computations allow users to combine any of the below options into a math formula. The drop down options allow users to choose from account groups, individual accounts, or a constant number (for example, days of the month). You can also choose how the result will be displayed.

Listed below are the eight display options available for computation account groups:

- Number

- Percent

- Ratio with decimals

- Ratio without decimals

- Daily average

- Weekly average

- Monthly average

- Quarterly average

Examples of Computations:

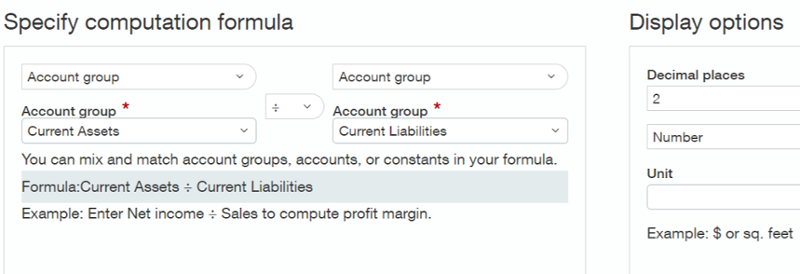

Current Ratio

In this example, I'll specify the computation formula for finding the current ratio. The computation formula is the account group "Current Assets" divided by the account group "Current Liabilities."

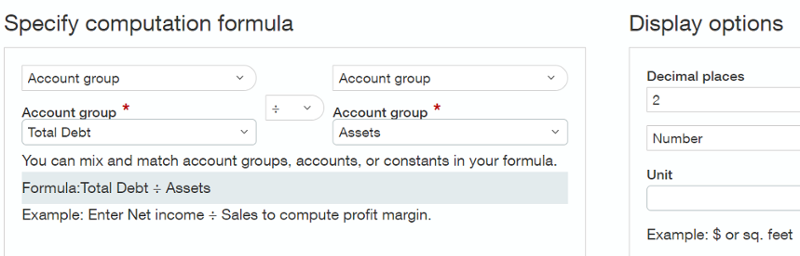

Debt Ratio

In this example, I'll specify the computation formula for finding the debt ratio .The computation formula is the account group "Total Debit" divided by the account group "Assets."

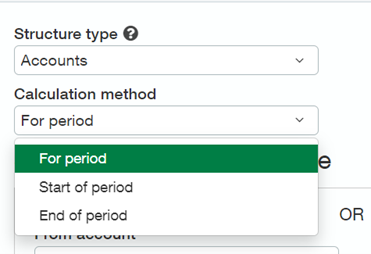

Customizing Your Account Groups

Intacct offers more customization options for account groups beyond the structure type. For example, users are able to select a calculation method (for period, start of period, end of period). These options can be nested by using different account groups and calculation methods in a computation. Many account groups will use the end of period option. For example, if you have a custom cash and cash equivalent account group you will likely want to use the end of period calculation method.

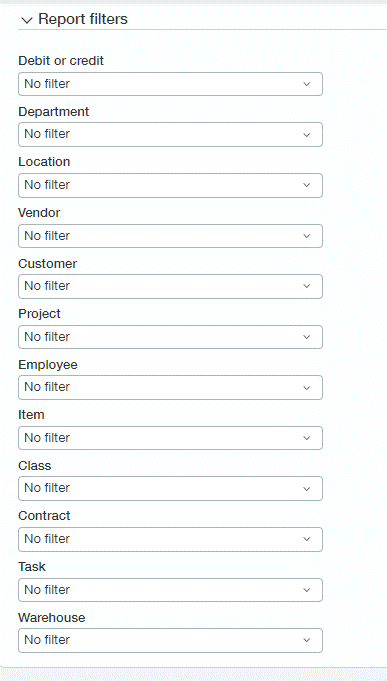

These custom account groups can be filtered by any of your dimensions (debit or credit, department, locations, vendor, customer, project, employee, item, class, contract, task, and warehouse). For example, an account group can be filtered down to a custom department group (a grouping of departments created within Intacct).

Using Account Groups in Financial Statements and Dashboards

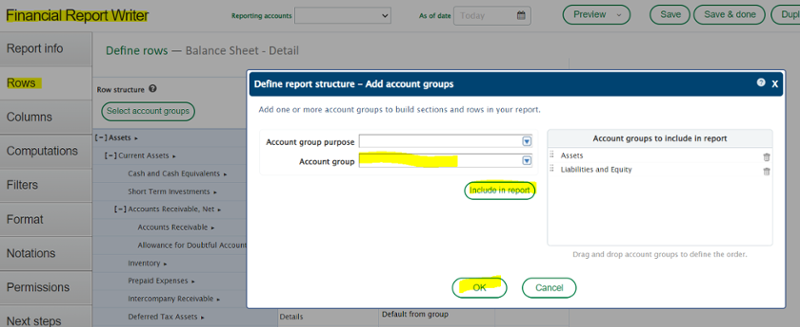

Once you have created your account group(s), you now have the opportunity to add them to your financial statements or dashboards. On financial statements, these account groups can be added via the rows tab. They can be reordered as needed.

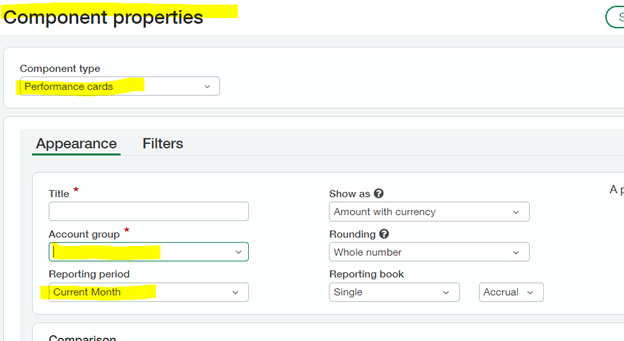

These account groups can be displayed on dashboards in various ways including performance cards. Please keep in mind the reporting periods on the dashboard as well as how they are calculated within the account group (ex: for period or end of period).

Want More Sage Intacct Features & Functions?

For more Sage Intacct Tips & Tricks videos, visit our YouTube page and subscribe to stay up-to-date with the latest insights and tutorials. Our channel is dedicated to providing valuable resources for businesses looking to optimize their financial management with Sage Intacct.

Check out these blogs to help get you started!

Check out these blogs to help get you started!

How to Use the Allocations Function

Using the 3 Types of AP Bill Approvals

Sage Intacct Budget Templates...IN ACTION!

How to Create a Prepaid Item and Amortization Schedule