Sage X3 allows users to define tax information for use in Purchasing or Sales. This allows the calculation of sales tax on purchase orders and purchase invoices or sales orders and sales invoices.

The steps below will walk through the setup and process of sales tax in Sage X3.

Overview

- Define a general ledger account for the tax postings

- Setup a Tax accounting code

- Define product tax levels

- Define BP tax rules (Customer / Supplier)

- Create the tax rates

- Setup the tax determination relationship

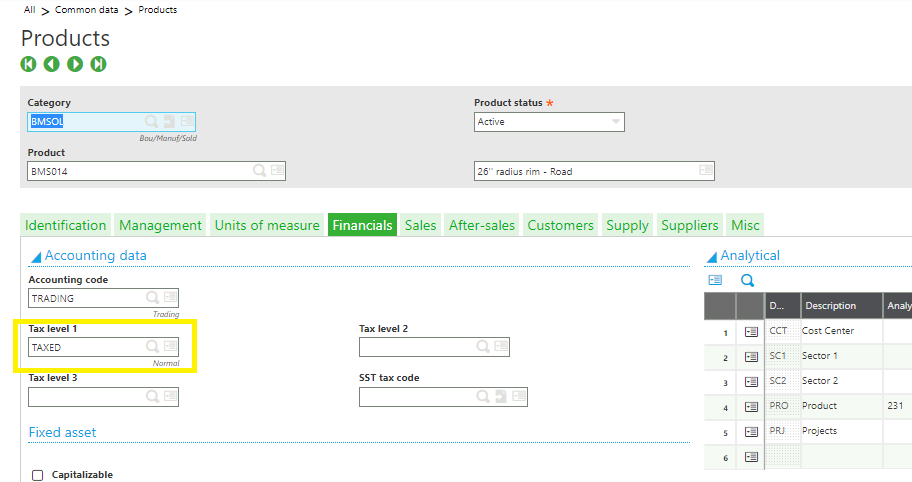

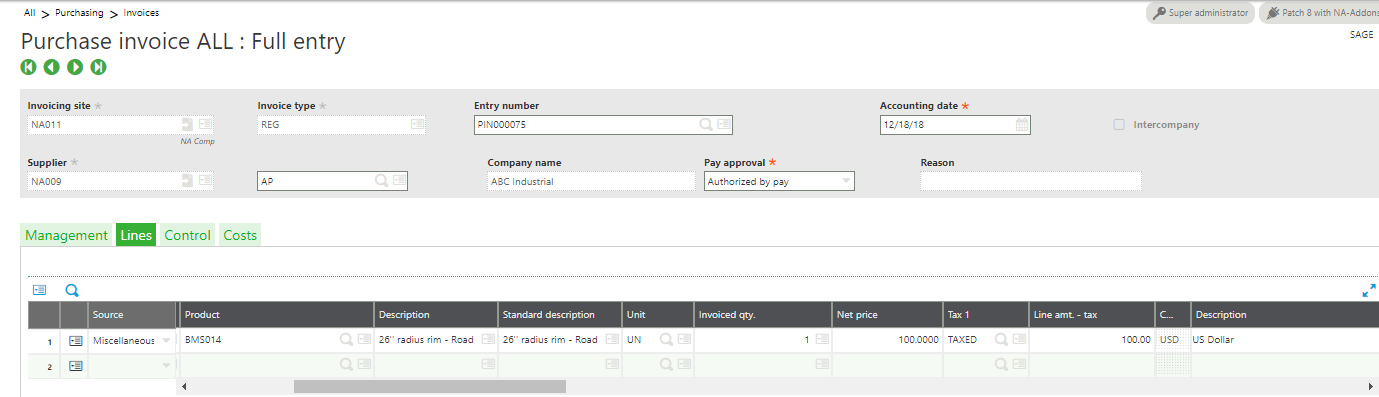

- Assign the product tax level to a product

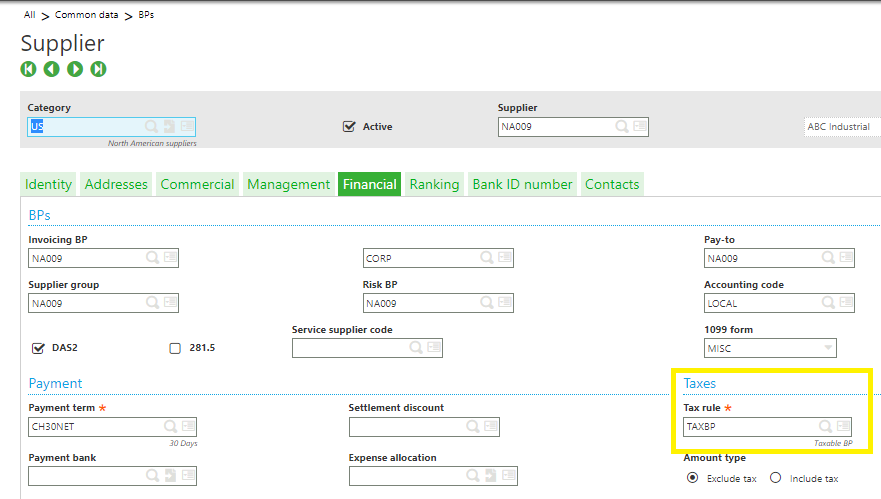

- Assign the tax rule to the supplier or customer

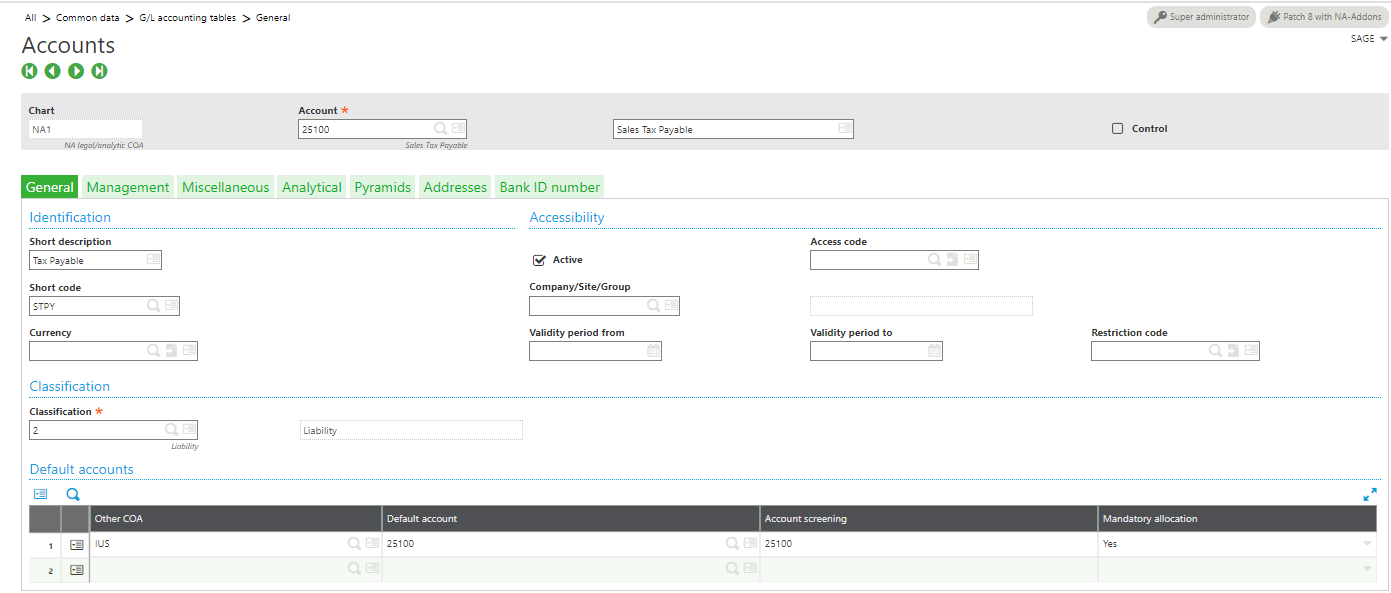

- Setup the Sales Tax GL Account

- Common Data > G/L accounting tables > General > Accounts

- Create a Sales Tax Payable and/or Sales Tax Expense account

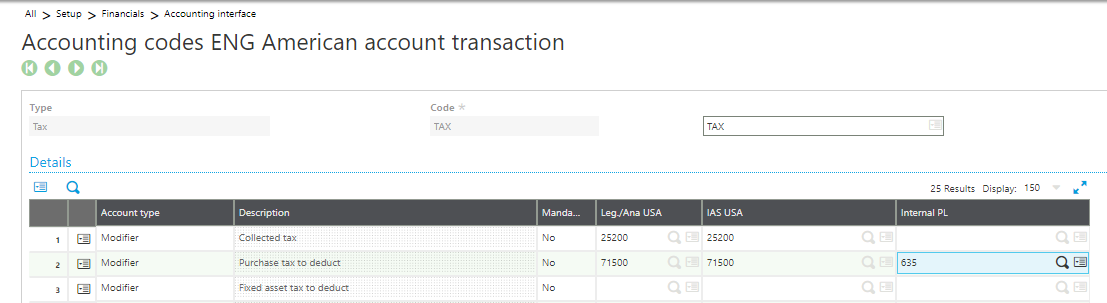

- Setup the Accounting code for Tax

- Setup > Financials > Accounting interface > Accounting Codes

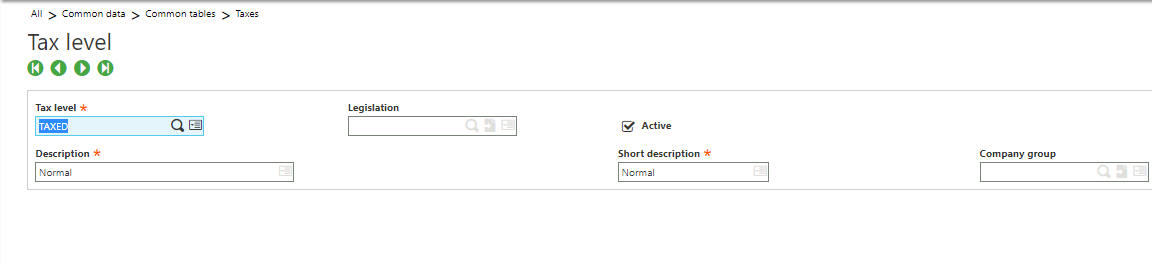

- Setup the Product Tax Levels

- Common data > Common tables > Taxes

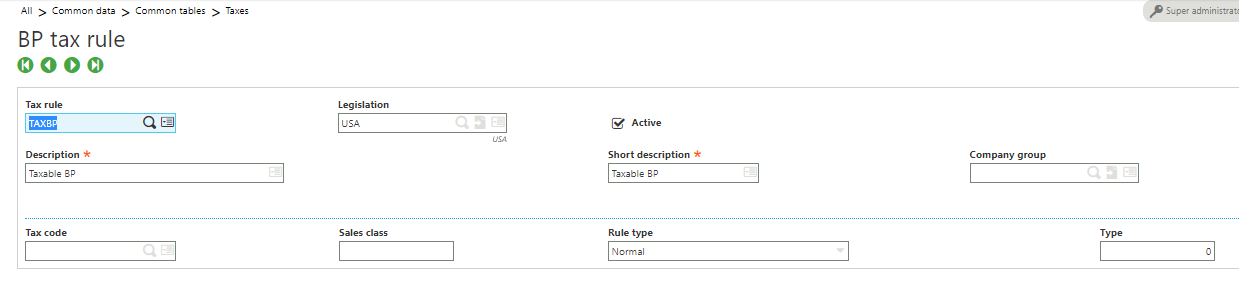

- Define the BP (Supplier / Customer) tax rules

- Common data > Common tables > Taxes > BP Tax Rule

- Define the Product Tax Level

- Common Data > Products > Products

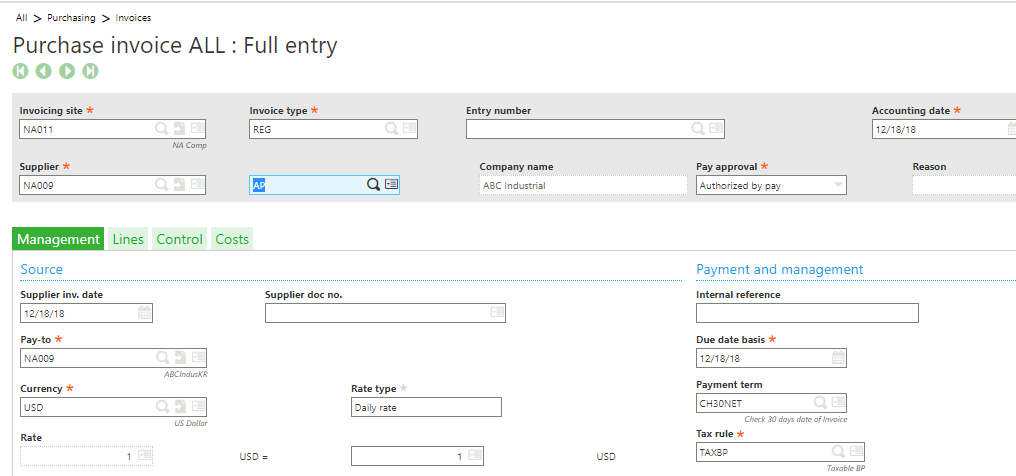

- Assign the tax to the BP (Supplier / Customer)

- Common data > BPs > Supplier or Customer

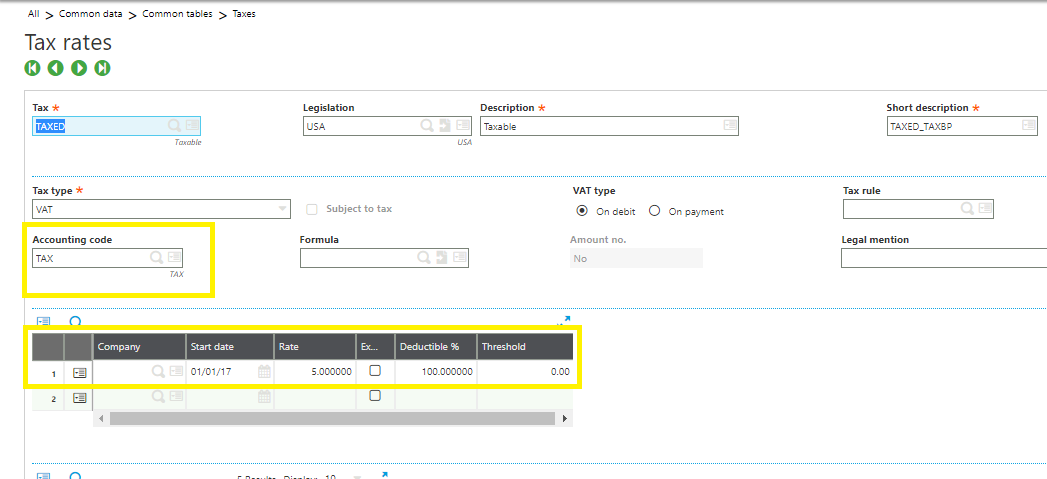

- Setup the Tax Rate

- Common data > Common tables > Taxes

- Select the Accounting code

- Enter the tax rate with a starting date

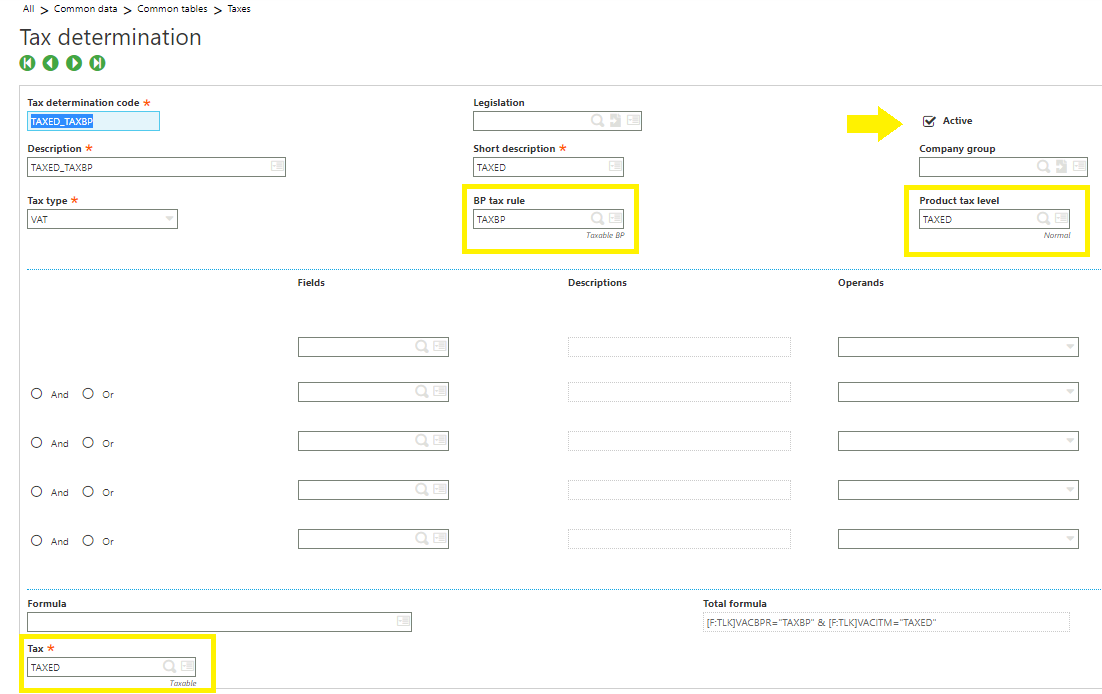

- Setup the Tax Determination

- Common data > Common tables > Taxes

- Select the BP Tax Rule and Product Tax Level

- Assign the tax code and set as Active

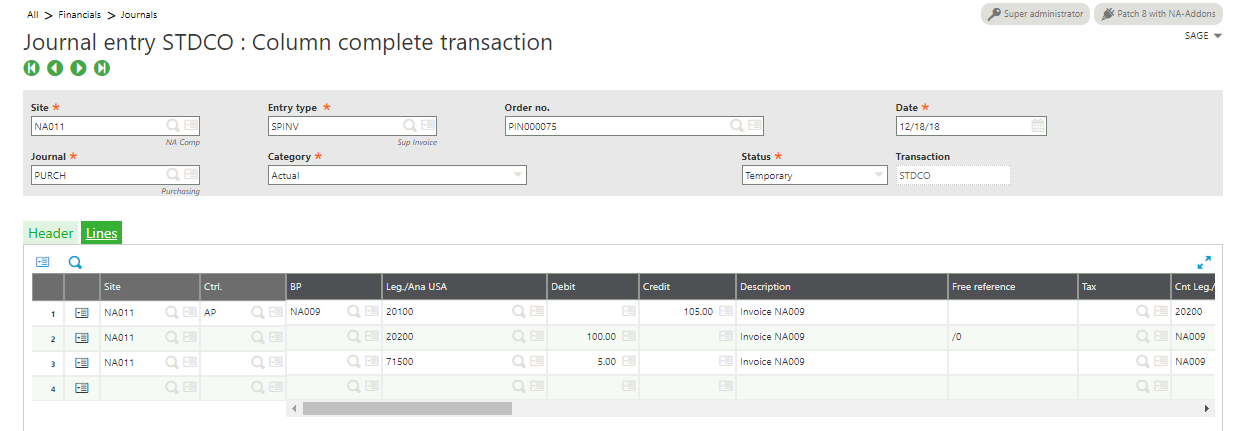

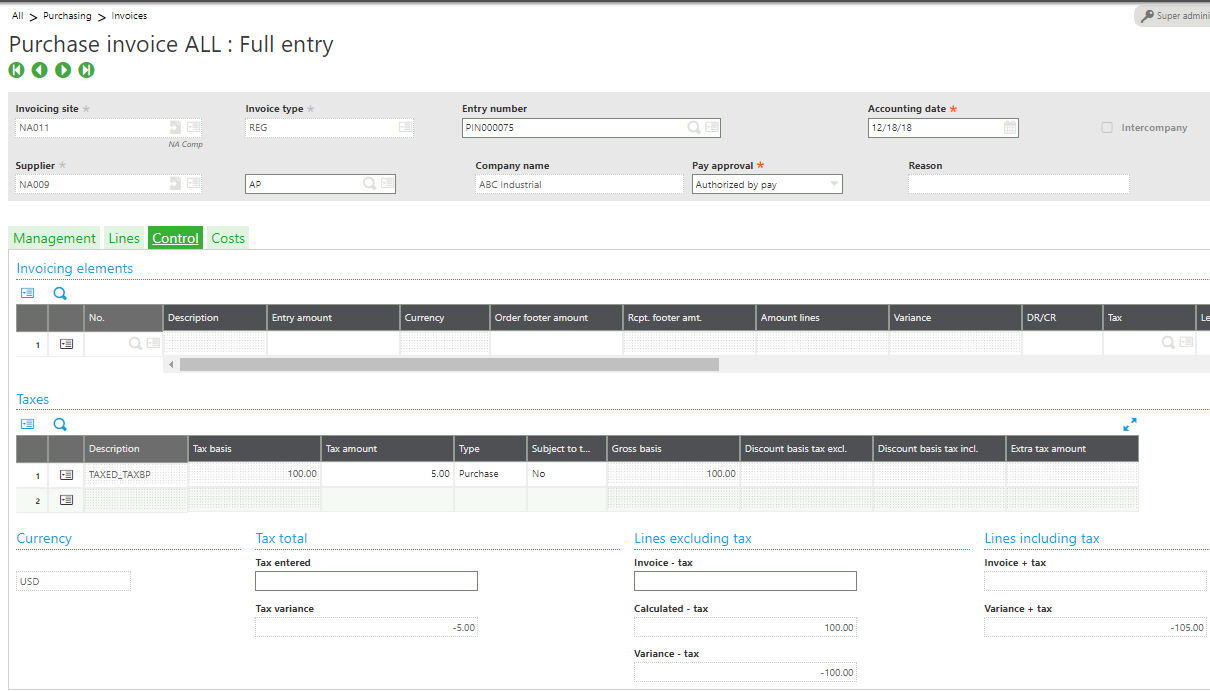

- Create a Purchase invoice and post.

- Review the GL Journal Entry