In an insightful white paper published by The Boston Consulting Group, BCG sets forth some very cogent points that should be—indeed, must be—considered by any supply chain managers hoping to increase their success over the coming years.

While almost every U.S. firm has sought to reduce the cash it has tied up in inventories over the last decade—and especially the latter half of this decade, The BCG’s recent research shows that those companies that have created advanced DDSCs (Demand-Driven Supply Chains) carry about one-third less inventory while improving delivery performance by 20 percent. And, they accomplish this at dramatically lower supply chain costs, as well.

Consider the following:

- The DDSC’s real-time visibility into demand and supply levels tends to stimulate unprecedented supply chain performance by the partners involved.

- Participants in DDSCs find that they can reduce inventory levels throughout the supply chain without doing damage to customer service levels.

- The lower costs and improved visibility found in DDSCs tend to benefit all supply-chain participants, not just a few at one end of the supply chain or the other.

Nevertheless, as we have discussed in other articles, creating a DDSC is not simple at present. There are really few to none plug-n-play solutions in the marketplace—especially for the small-to-midsized business enterprises (SMEs) of the world. While the willingness of potential players in supply chains is growing—as more and more trust in cloud-based and SaaS (software-as-a-service) is blossoming—there is still the hurdle of finding a solution that is right-sized and right-priced for the middle-market.

It is also worth noting that the transition to any kind of DDSC is not always easy for long-established SMEs. In part this resistance comes from the very fierce independence upon which many of these firms were founded to begin with. Old habits, old processes, old business structures and old thinking die hard, hinder change and, too frequently, limit the success achieved, as well. In addition, half-measures, if instituted, often yield far less than half the desired results. Some half-measures may actually make things worse rather than better—increasing costs or operating expenses, for example, while creating no positive returns or benefits for any of the supply chain participants.

Negative experiences with half-measures and spotty attempts at Lean or methods without an accompanying cultural shift in the organizations involved also take their toll. Such failures and false-starts make it all the more difficult to get supply chain participants committed and involved in fresh attempts at supply chain integration and collaboration.

Six Factors for Success

In their referenced white paper, The Boston Consulting Group has identified six factors that they believe are critical to the success of building and sustaining a truly demand-driven supply chain:

- Building the right technical infrastructure

- Improving data collection and analysis

- Rethinking operations

- Realigning performance metrics and incentive plans

- Cogently managing the trade-offs between cost and service

- Effecting change in the corporate culture

We will discuss these briefly over the next several articles.

1. Building the Right Technical Infrastructure

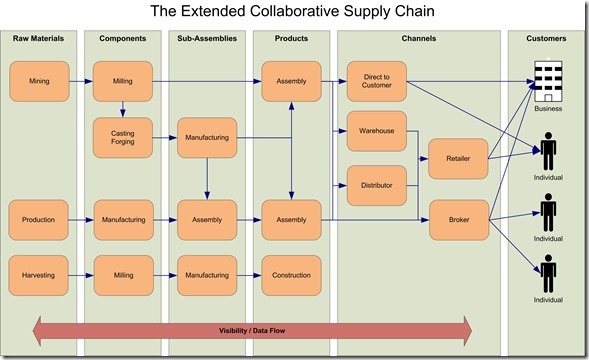

It is the end-to-end visibility of demand and supply data across the supply chain that makes DDSCs really work. It is essential for the participants to be joined together around a data-exchange platform that provides both visibility and security. Visibility is essential to make DDSCs work, and the security is essential to make it safe for the participants to share sensitive data. Each participant must be fully confident in knowing that they have absolute control over their data—knowing precisely which data will be shared with which participants in the supply chain.

Since it is inevitable that trading partners will change over time—some with more frequency and some with less—DDSCs can become exceedingly costly for the participants if each data interface becomes an exercise in customization and modification to create the connections between the various trading partners. Ideally, the right technical infrastructure is one where mappings between source data (in an inventory, warehouse or ERP system) and the exchange platform (in the cloud) can easily be created and set to active with the involvement of not more than a minimum of technical skills.

Security between trading partners should also be manageable by folks with typical computer skills, and the security must be flexible, as well. A trading partner should be able to designate which kinds of data (e.g., data columns) and even which specific data sets (e.g., SKUs, product lines) will be made visible to which other (specific) trading partners. Changing these settings to include more or less data should be simple and take only minutes.

The data exchange itself must, of course, demonstrate reliability and speed. Similarly, the platform must be flexible, scalable and offer robust trading features. But the exchange can offer much more to its clients. It can offer intelligence that helps reduce errors between exchange partners by monitoring transactions and developing heuristic methods that might call users’ attention to pending transactions that may contain data entry errors (i.e., too many zeros in an order quantity; the order for ‘model 1001’ when the customer always before has ordered only ‘model 1010’ in that product line). The exchange can even be used by participants to help identify new sources for the products they want to purchase. After all, finding another source already on the exchange means the time to connect and begin DDSC collaboration could be minutes or days, instead of weeks or months.

In part 2, we will talk about IMPROVING DATA COLLECTION AND ANALYSIS, and more.