You made it through January 1099 season and you thought you were done, only to find out that you need to do some 1099 corrections. As you may know, Aatrix required a new process this year, whether you printed 1099’s on your own printer or you e-filed. The corrections can be nerve wracking but this blog will take you step-by-step through the new 1099 corrections process so you can feel confident in your final documents.

What you need to know about the new Aatrix process before you begin:

Since Aatrix creates a file on your computer, you will need to be logged in to the same computer you processed your 1099’s on previously. This includes Terminal Server “farms” where the user cannot control which IP they are logged into. To push the user to the correct IP, an admin user will need to use the mstsc.exe switch.

Entering Corrections

- Launch the 1099 Forms (2016+) task from your Sage desktop.

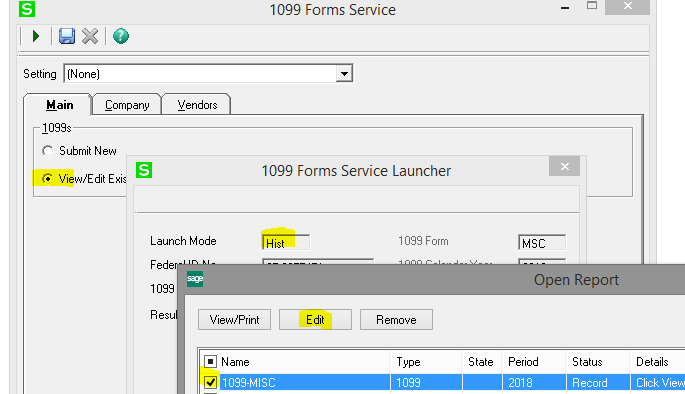

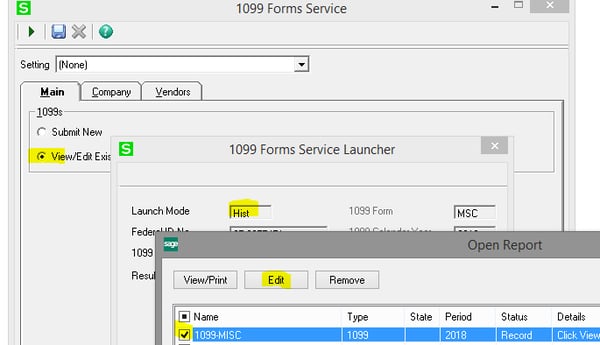

- While on the Submit New option, verify that the correct 1099 Form, Calendar Year, and Amounts are correct. Click on the View/Edit Existing option and click the green proceed button.

- You may be prompted to update forms again. Proceed with updates.

- Once the Open Report window is launched, you will be able to select the 1099 form previously submitted. Click the check box to select the line, and then click Edit. Please note that you will see the launch mode set to Hist on the 1099 Forms Service Launcher.

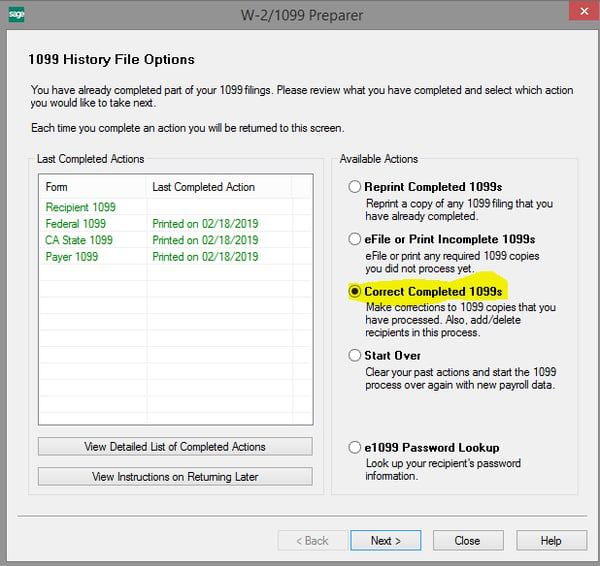

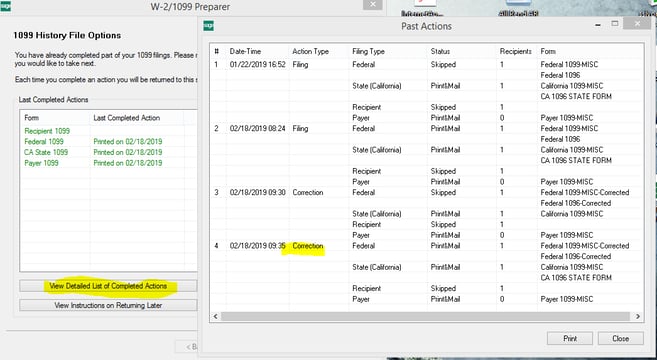

- The 1099 History File Options window will appear which will give you the option to Correct Completed 1099s. This is the corrections option which you will select.

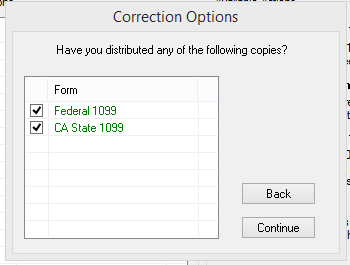

- Confirm the correction options for Federal and/or State. You will only complete corrections AFTER distributing the original 1099s. Click Continue

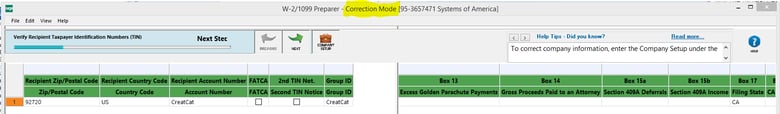

- You are presented with the Aatrix grid to make your corrections to your 1099 file.

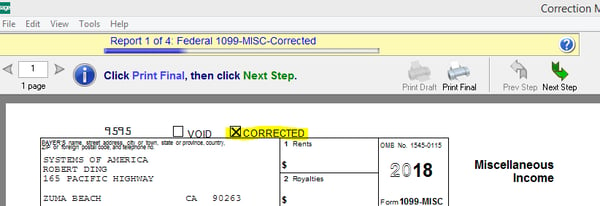

- Once corrections have been completed, re-print your final copies of 1099 and resubmit using Aatrix or print on your tax paper. You will see the Corrected box checked.

- You may confirm the actions taken in Aatrix by clicking the View Detailed List of Completed Actions.

Still need more help filing your 1099 Corrections with Aatrix? Contact us using the form below.