This is Part 3 of 4 in the sustainability series brought to you by Lisa Peterson, a sustainability consultant at Aftan Engineering who specializes in helping companies become compliant.

Part 1: Feeling the Pressure of Sustainability?

Part 2: The Alphabet Soup of Sustainability: Making Sense of the Acronyms

Part 4: Kick-Off Your Sustainability Journey

Is your company upstream or downstream of a publicly traded corporation? If the answer is yes, this blog is for you. If the answer is no, please think again. Most companies, even the smallest of companies, have an eventual touchpoint to a large publicly traded corporation.

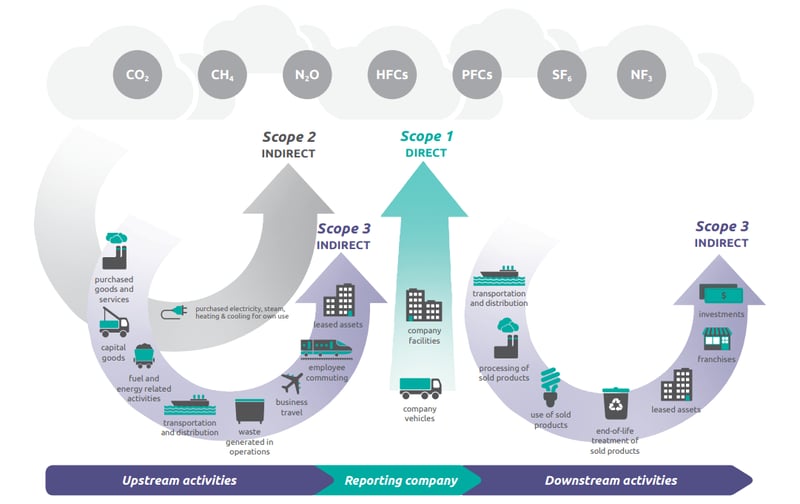

Companies typically start their greenhouse gas (GHG) reporting by measuring emissions from their own operations and their own electricity consumption. Then they expand to look at emissions coming from outside of their own walls and their own operations. These include the emissions from the goods purchased to the disposal of products sold and everything in between. When assessments are done, it is quite common to see the majority of total corporate emissions coming from the value chain rather than from within the corporation’s operations.

As investors seek to minimize risk and maximize return, there has been a growing demand for publicly traded corporations to report on their greenhouse (GHG) emissions. Reporting is perceived by the investment community as having a sustainable competitive advantage.

In early 2022, the Securities and Exchange Commission announced proposed rule amendments requiring climate-related information to be included in corporate reports; and Scope 3 emissions are one of the elements noted in the list of disclosures.

What are Scope 1, 2, and 3 emissions?

- Scope 1 emissions are the direct emissions from a company including the company facility and the company vehicles.

- Scope 2 emissions are the indirect emissions of the company. These are the emissions from purchased electricity, steam, heating and cooling used by the company.

- Scope 3 emissions are the indirect emissions from the entire value chain of the reporting company. These are the emissions not included in Scope 1 and 2. They come from everything upstream and downstream of the reporting company; they can be significant; and they are commonly referred to as “the holy grail of emissions.” There are 15 categories of Scope 3 emissions, and this is where your company may be requested to provide information to a corporation in your value chain who may need to report to the SEC.

Source: GHG Protocol, Figure 1.1 of Scope 3 Standard

A Deeper Dive into the 15 Categories of Scope 3 Emissions

For corporations to report on Scope 3 emissions per the SEC ruling, they must partner with their suppliers and customers. Take special note of the categories in bold as these are likely how your company may be involved in reporting.

Upstream Activities

- Purchased goods and services (upstream emissions from the production of goods and services purchased by the reporting company)

- Capital goods (emissions from products used by reporting company to manufacture a product or provide a service) [Note: Unlike financial accounting, the emissions from capital goods cannot be depreciated, discounted, or amortized, but must be fully accounted for in the year of acquisition.]

- Fuel and energy related (emissions from production of fuels and energy purchased and consumed by reporting company)

- Transportation and distribution (emissions from transportation of products from suppliers by land, sea, and air as well as warehousing)

- Waste from operations (emissions from wastes sent to landfills and wastewater treatment)

- Business travel (emissions from air, rail, taxis, buses, and business mileage using personal vehicles)

- Employee commute (emissions from travel to and from work)

- Leased assets (emissions from leased assets by the reporting company)

Downstream Activities

- Investments (emissions from equity investments, debt investments, project finance, managed investments, and client services)

- Franchises (emissions from businesses operating under a license to sell or distribute goods or services)

- Leased assets (emissions from assets leased by the reporting company to others)

- End-of-life treatment of sold products (emissions from products sold when disposed of)

- Use of sold products (emissions from product usage)

- Processing of sold products (emissions from processing of intermediate products sold by downstream manufacturers)

- Transportation and distribution (emissions from transportation of products going to customers by land, sea, and air as well as warehousing)

When Will the New SEC Rule Affect Your Company?

For most companies, their product or service falls into one of the 15 categories above at some point during its lifetime. If it is not directly used as a product or service by a reporting company, it may become part of another product or service, a piece of capital, or a leased asset, which means this rule could affect any company. It is expected that the SEC proposed rule will become effective within the 2022 calendar year; and if that happens, large accelerated filers could begin reporting on Scope 3 emissions for fiscal year 2024, while accelerated and non-accelerated filers could begin reporting for fiscal year 2025. Large publicly traded companies will reach out through their value chain to their suppliers and their customers informing them of their need for information about their emissions. In addition, they will provide expectations and goals that they are looking for from their suppliers and customers to meet emission goals.

Some companies are already seeing the request for emission information coming from various customers, all aimed at the same goal of disclosing climate-related metrics. To best prepare, assess your scope 1 and 2 emissions, and be prepared to share that information with your customers when then ask. Your scope 1 and 2 emissions are viewed as scope 3 emissions to your customers.

Be prepared to answer your customers’ questions about emissions because the frequency of companies needing to provide emission information is growing rapidly.

About Aftan Engineering, LLC

Aftan Engineering is a company based out of Pennsylvania that specializes in Sustainability and Continuous Improvement challenges. Led by Lisa Peterson, they offer services pertaining to Sustainability, ISO 14001 Compliance Preparation, Lean Six Sigma, Continuous Process Improvement (Manufacturing Optimization), Supply Chain Management, and 3D Printing (Additive Manufacturing).

Feel free to contact us or Lisa directly for more information about a sustainability compliance consultation or for any inquiries and/or questions.