The Positive Pay is an enhancement to Accounts Payable check payment process for Sage 500. This enhancement will give users the ability to extract check information onto a file. The system generated file extract can be submitted to a bank institution as a form of verification to eliminate check fraud. The file will contain information specifically needed for Positive Pay such as check number, account number, issue date, and dollar amount. When a check is presented to a bank for payment, the bank reviews the Positive Pay transmission to see if the check is valid. A check will only be honored if the Positive Pay transmission matches the payment details.

Positive Pay VS. ACH/EFT

Positive Pay is not to be confused with the term ‘ACH’ or ‘EFT’. Although both entities generate check information onto a file, the Positive Pay extract file is only used as a form of check verification in Sage 500. It does not create an actual payment to the bank.

The Positive Pay enhancement is available in the AP system and manual check batch process. The batch screen will function as follows:

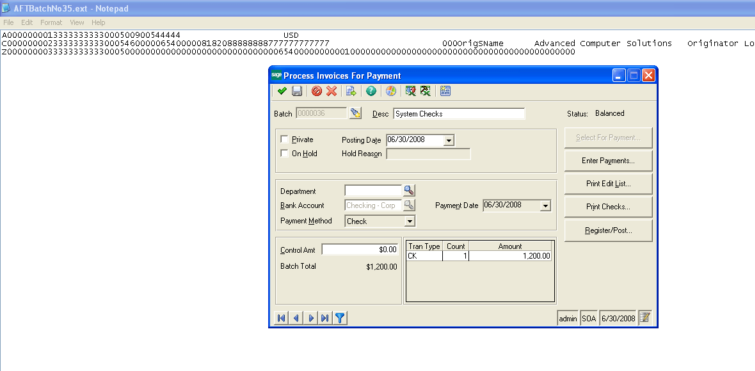

- Click on either ‘Process Invoices for Payment’ batch screen or ‘Process Manual Checks’ batch screen. (Accounts Payable | Activities folder)

- Select a payment method of ‘Checks’. This enhancement will not function if the payment method is ‘EFT’. (See Figure 1)

- Create payment records.

Setting up Positive Pay in Sage 500

- Click on ‘Register/Post’ button. A new ‘Extract check information file’ checkbox will appear at the bottom right corner of the ‘Register/Post’ screen under the heading ‘Positive Pay File Extract’. (See Figure 2)

- Click on the extract checkbox and then click on the ‘Set Directory’ button. Select a valid directory for saving the extract file. (See Figure 3)

- Click on the ‘Proceed Button’. During the post process, a Positive Pay extract file will be generated and a message box will appear to give the user to the ability to verify the format of the extract file prior to proceeding with post (See Figure 4).

Check Printing

The Positive Pay enhancement for Sage 500 is an additional feature to the check printing process. It does not; however, replace check printing altogether. The user will still be required to print checks prior to posting.

Sage 500 Positive Pay File Format

The following information outlines the format of the Positive Pay extract file which is common for most banks:

DETAIL - RECORD TYPE 10

ACCOUNT TOTAL - RECORD TYPE 20

FILE - RECORD TYPE 30

Sample Positive Pay extract file

Limitations

Cannot generate Positive Pay File after Post in Sage 500

Positive Pay file cannot be reproduced once the batch is posted.

No Standards for Positive Pay

Unlike ACH there are no set of standards for Positive Pay. Each bank has its own unique file format in which data should be submitted.

Have Questions or Need Help?

Ask a Question