Sage has now released their 1099 updates for calendar year 2014. The updates are available for customers who are on the following versions:

Sage 500 ERP 2014: Minimum Requirement: Sage 500 ERP 2014 RTM or newer must be installed before year 2014 stand-alone 1099 update can be installed.

Sage 500 ERP 2013: Minimum Requirement: Sage 500 ERP 2013 January 2014 Product Update (7.50.5) or newer must be installed before year 2014 stand-alone 1099 update can be installed.

Sage 500 ERP 7.4: Minimum Requirement: Sage 500 ERP v7.40 January 2014 Product Update (7.40.10) or newer must be installed before year 2014 stand-alone 1099 update can be installed.

If you are on a version of Sage 500 ERP outside this supported range, we can still apply the 1099 changes to your environment, but we would recommend installing the files on a computer that is not used for normal Sage 500 ERP functions and generating your 1099s from that computer. That way, we will not run the risk of affecting other areas of the program and interfering with your daily tasks.

As we have in past years, RKL eSolutions will provide 1099 updates to customers who do not meet these minimum requirements. We have already retro-fitted the 1099 update into Sage 500 ERP 7.3, 7.2 and 7.05! The update contains 3 crystal report files, a new dll file, and a new executable to deploy to the client workstations. There are also 2 scripts that need to be applied to the Sage 500 ERP database.

Please let us know if you would like to schedule the 1099 installation on your system. Please contact us today at support@rklesolutions.com

Here are the IRS changes the update includes:

Electronic Filing Programming Changes (from IRS Publication 1220)

1099-INT:

Payer "A" Record - Two new amount codes:

- Amount Code A, Market discount – field positions 163-174.

- Amount Code B, Bond Premium – field positions 175-186.

1099-MISC:

- Payer "A" Record – Deleted Amount Code 9, Foreign Tax Paid (no longer reported).

1099-DIV:

No changes

Combined Federal/State Filing Program

- Removed state IOWA from efiling.

- Payee “B” Record - Removed State Code 19 from field positions 747-748.

- State Total “K” Record - Removed State Code 19 from field positions 747-748.

Form Printing Changes (from IRS Instructions for 1099-DIV, 1099-INT, 1099-MISC)

1099-INT:

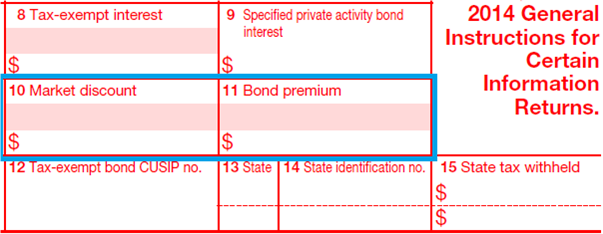

Box 10 and Box 11 are now new reporting boxes as Box 10(Market discount) and Box 11(Bond premium). Marked in blue.

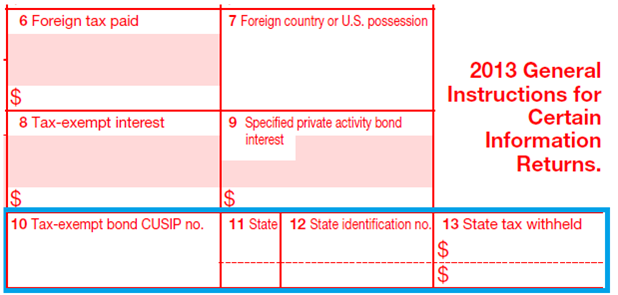

- Box 10(exempt bond CUSIP no.), Box 11(State), Box 12(State identification no.) and Box 13(State tax withheld) in 2013(1099-INT) form are now moved as Box 12, Box 13, Box 14 and Box 15 respectively in 2014 (1099-INT) form. Box 10(Market discount) and Box 11(Bond Premium) have been added.

1099 INT (2013)

1099 INT (2014)

- The value of Box 12(Tax-exempt bond CUSIP no.) is stored in the Related Box Text of Box 8(Tax-exempt interest).

Example:

- The value of Box 14(State identification no.) is stored in the Related Box Text of Box 10(Market discount).

Example:

- Box 11 (Foreign tax paid) and Box 12 (Foreign country or US possession) added to the 2013 1099-MISC form has been removed on the 2014 1099-MISC form.

1099-MISC (2013)

1099-MISC (2014)