Revenue Recognition Software: Get Your Accounting House in Order with ASC 606 Compliance

With the upcoming revenue recognition changes, the accounting department is the ideal place to start your spring cleaning. These changes are the most sweeping to come in a decade, and many companies need to freshen up their accounting practices in order to get compliant.

For many companies, this is a wake-up call in terms of how they recognize revenue. It’s no longer an “anything-goes” philosophy when it comes to amortizing revenue. It’s a time to balance the creativity of the sales team with the new standard accounting practices that need to be in place. No more “one-off” contracts and special subscriptions. Standardizing contract details will be essential so accounting can properly capture details and recognize revenue in line with the new rules.

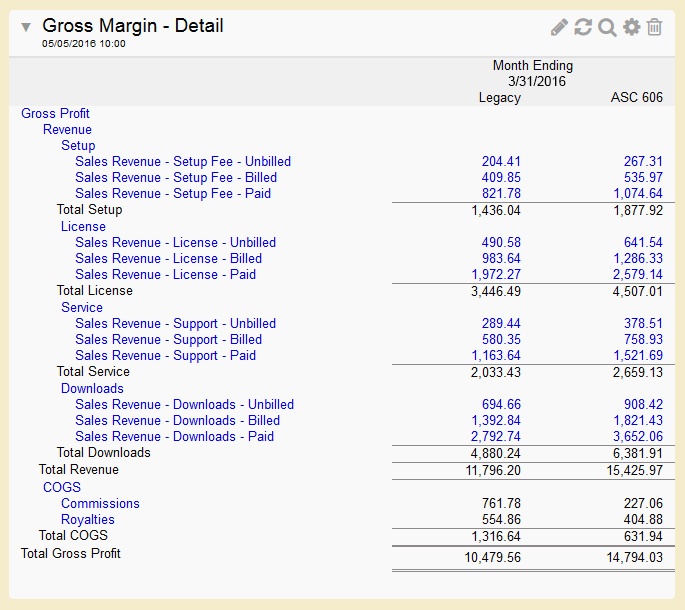

We’re in the midst of a rather messy transition period right now where there are important rules for tracking and reporting revenue under both methods. In order to adopt the new standards, FASB has issued guidelines for what a business can do to adopt the new standard that organizations should implement immediately. Those that use Excel-based accounting practices could find themselves facing an even dirtier task.

To help you make room for the new standard, we’ve provided five steps to recognizing revenue for subscription-based businesses:

1- Identify contracts and thresholds

Under ASC 606, organizations are required to treat multiple related contracts as a single contract. To meet this requirement, your accounting system should be “contract aware,” with contract management capabilities built in. You won’t be able to recognize revenue until a contract reaches a collect ability threshold—or until the contract is amended. Take the first step toward compliance by identifying contracts and tracking the likelihood that the contract will actually be collected.

2- Manage performance obligations and renewals

A “performance obligation” is a promise to deliver a good or service. Identifying a performance obligation according to ASC 606 criteria will help determine when and how much revenue will be recognized. Establishing a uniform procedure for handling performance obligations is essential—and so is the need to have “contract intelligence” in your accounting system.

3- Determine the transaction price

In most cases, a transaction price is what a business expects to be paid for its goods or services. Under ASC 606, things are more difficult for companies with complex contracts or subscriptions. Organizations should establish processes and controls around valuation methods. These allow you to apply consistent methods and identify contracts with non-standard terms.

With templates and schedules that automatically allocate revenue and amortize expenses, Intacct can handle dual treatment of contracts, as well as important integrations

4- Allocate the transaction price

The next step is to allocate a part of the transaction price (step three) to each performance obligation (step two), based on the relative standalone sales price. This takes a complex, rules-based approach that is beyond the scope of spreadsheets and Excel-based accounting systems.

5- Recognize the revenue

With ASC 606, subscription-based companies will recognize revenue over time as the customer receives the goods or services (the performance obligations). Billing and revenue recognition systems need to work in sync so that your company can recognize the income each time the performance obligation is completed.

Reworking your accounting systems to meet ASC 606 requirements may seem like backbreaking—or at least mind-bending—work. Fortunately, there’s Intacct. With templates and schedules that automatically allocate revenue and amortize expenses, Intacct can handle dual treatment of contracts, as well as important integrations. With Intacct, the pros at RKL eSolutions can help you clear out the clutter of old accounting practices and make room for full compliance.