Compliance Complexity is Growing

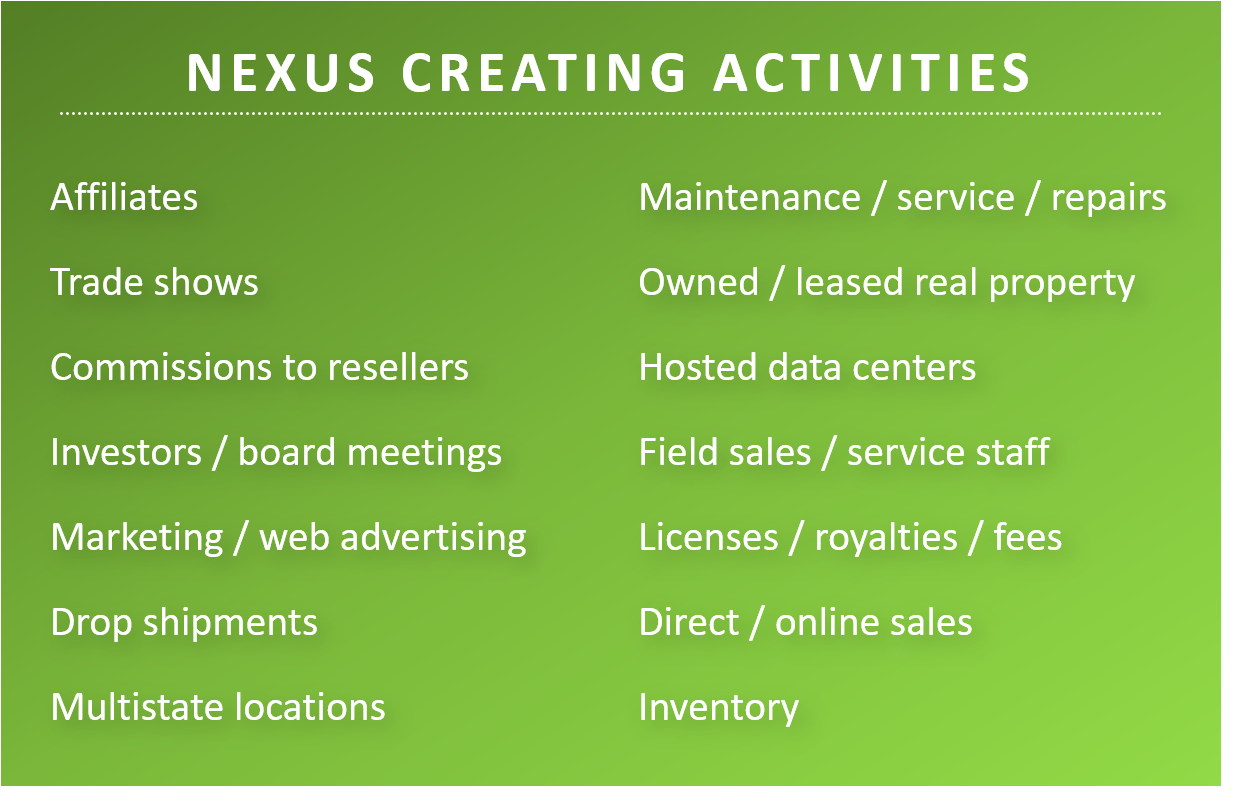

Sales tax landscape is complex and changing all the time. Different states have different rules with regards to economic nexus, and these rules are constantly changing. The increasing pressure to comply plus validation complexity exposes business to increased risk, and states will capitalize on that risk.

In general sales tax accounts for nearly half of most states annual revenue. It is estimated that there is $13 Billion in uncollected sales tax revenue (Government Accountability Office report, November 2017). If states are loosing revenue, especially with less consumer shopping, an easy way to make up for the lost revenue is sales tax audit.

WEBINAR REPLAY NEXUS 101

Sign up for the Avalara Nexus study and receive special pricing of 50% off during the month of April. Contact us for a sample copy of the Nexus study -> RKL eSolutions